The new draft legislation requiring an evaluator’s opinion on connected pre-packs has drawn most attention. But the measures will affect more than just connected pre-packs and the Insolvency Service’s report reveals other planned efforts to influence IPs’ activities and disclosures.

In this article, I focus on the less-publicised changes that are afoot, including:

- The impact on post-appointment connected party sales

- The option of seeking creditors’ approval, rather than getting an independent opinion

- The government’s desire to increase the use of viability statements

- The emphasis on SIP16’s “comply or explain” requirement

- The government’s wish for RPBs to probe into cases where marketing is not undertaken

- The need for greater compliance with SIP16’s disclosure requirements

The Insolvency Service’s Pre-Pack Sales in Administration Report and the draft regulations are at: https://www.gov.uk/government/publications/pre-pack-sales-in-administration.

The draft regulations are not about pre-packs

No, really, they’re not. The draft regulations impose new requirements on:

- Connected party sales only

- But not just connected party pre-packs, also any sales of “all or a substantial part of the company’s business or assets” within 8 weeks of the start of the Administration

- How is a “substantial part” defined? It isn’t. It will be up to Administrators to form an opinion about whether a sale involves a substantial part

- And the regs will capture not just sales, but also the “hiring out” of all or a substantial part of the business or assets

Why interfere with post-appointment sales?

The Insolvency Service’s report does not explain or seek to justify this step. It seems to suggest that, because the SBEE Act’s power to legislate extended to all connected party sales, they were free to regulate all such sales. However, they have graciously decided “only” to apply the requirements to sales within 8 weeks of the start of the Administration.

So… a secured lender appoints Administrators perhaps in a hostile manner. The Administrators have had no contact with the director before their appointment, but they soon learn that the director is anxious to hold onto the business so will offer almost anything. The Administrators are keen to recover as much as possible for their appointor and, as is their statutory duty, to care also for other creditors’ interests, so they play hard ball to squeeze out the best deal. The Administrators’ agents recommend that they snap up the offer – maybe they’ve now carried out some marketing, maybe it’s a no brainer that no unconnected party in their right mind would offer anything approaching the director’s offer – the secured lender is happy with it, and the Administrators make sure that the purchaser is good for the money. But still the purchaser must instruct an independent evaluator?

What will the evaluator evaluate?

The evaluator’s report must state whether or not they are:

“satisfied that the consideration to be provided for the relevant property and the grounds for the substantial disposal are reasonable in the circumstances”

It seems to me that the people best-placed to evaluate whether the consideration is reasonable are professional agents, aren’t they? Shame that independent, qualified, PII’d agents instructed by the Administrators to do just that cannot be trusted with this task, isn’t it?

How does someone assess whether “the grounds for the substantial disposal” are reasonable? It’s not “the grounds for Administration”, so this will not address the cynics’ belief that directors engineer companies into Administration to “dump debts” and start again. I’m not saying this happens often, if at all. Unnecessarily putting yourself through an Administration and then battling to restore, or to build new, trust of suppliers, employees, and customers seems a drastic step to take. I think that many connected purchasers underestimate the struggles ahead of them.

Presumably, “the grounds for the substantial disposal” relates to the question: could a better price be achieved by a different strategy? This sounds like a debate about the marketing strategy, the prospects of alternative offers, and going concern v break-up, so again professional and experienced agents seem best-placed to make this evaluation.

But why not just ask the Pool?

I understand the noises of: what’s wrong with simply asking the Pre-Pack Pool? But I return to the question: why have an opinion in the first place? It won’t dispel the suspicions that the whole thing has been designed by the directors who shouldn’t be allowed to use Administration or Liquidation and it won’t answer the many who just believe that it’s wrong for a director to be allowed to buy the business or assets from an Administrator or Liquidator. The public comments below The Times’ articles on pre-packs say it clearly: some people call connected party sales (and CVAs) “fraud” or “legal theft”. How do you persuade these people to see things differently?

The strongest argument I could find in the Insolvency Service report for a Pool opinion was:

“Whilst some stakeholders said that an opinion from the Pool (or lack of one) would not affect their decision to trade with a business that was sold to a connected party purchaser, other creditor groups said that their members valued the Pool’s decision, and that the opinion did influence their decision as to whether to trade with the new company. They also stated that where the Pool had been utilised, the opinion given helped to demonstrate to creditors that in some circumstances a sale to a connected party provided a reasonable outcome for creditors.”

So some say it helps, some say it doesn’t.

Somehow the Insolvency Service concluded that their “review has found that some connected party pre-packs are still a cause for concern for those affected by them and there is still the perception that they are not always in the best interests of creditors”, but I saw nowhere in the report where those perceptions originate. The report referred to the media and the CIG Bill Parliamentary debates. Is that your evidence? Oh yes, some Parliamentarians have been very colourful in their descriptions of pre-packs; one said that the directors offer “a nominal sum – maybe only £1 or a similarly trivial sum”. Their ignorance – or the way they have been misled to believe this stuff – is shameful and on the back of such statements, distrust of connected party pre-packs grows and so the case for an independent opinion is made.

And now the R3 President is reported as saying that “effectively anyone will be allowed to provide an independent opinion on a connected party pre-pack sale, which risks abuse of the system that undermines the entire rationale of these reforms”. Again, we feed the beast that bellows that IPs – and professional agents – cannot be trusted.

So, ok, if it makes you happy, fine, let it be a Pre-Pack Pool opinion. In my view, they have fallen far short of justifying their existence, but if it shuts the mouths of some who see pre-packs as “Frankenstein monsters” (The Times) or at least gives them pause, then so be it.

Getting creditors’ approval as an alternative

The draft regulations provide that, as an alternative to getting an evaluator’s opinion, a substantial disposal to a connected party may be completed if:

“the administrator seeks a decision from the company’s creditors under paragraph 51(1) or paragraph 52(2) of Schedule B1 and the creditors approve the administrator’s proposals without modification, or with modification to which the administrator consents”

This must be achieved before the substantial disposal is made, so it will not be available for pre-packs… unless you can drag out the deal for 14+ days.

Could it help for post-appointment business sales? Provided that you don’t make a Para 52(1)(a), (b) or (c) statement in your proposals, it might. And let’s face it, if you’re issuing proposals immediately on appointment and before you’ve sold the business and assets, you may be hard pressed to make any positive statement about the outcome of the Administration.

But if you issue proposals immediately, i.e. before you have negotiated a potential deal with anyone, what exactly would the creditors be approving? Presumably, they would be informed of your strategy to market the business and assets and shake out the best deal from that. They would not be informed of what offers (if any) are on the table and it would be commercial suicide for the proposals to include valuations. Would such vague proposals achieve what the Insolvency Service is expecting from this statutory provision?

Could it be that the Service recognises that true post-appointment connected party sales (i.e. not those that avoid the pre-pack label by resisting negotiation until a minute past appointment) do not require independent scrutiny and this is their way of avoiding putting them all in that basket?

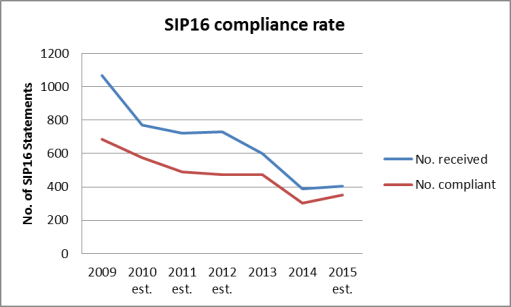

Smartening up on SIP16 statement compliance

The Insolvency Service reports that SIP16 statement compliance has improved: since the RPBs took on monitoring compliance in late 2015, the annual non-compliance rate has dropped from 38% to 23%. The report states, however, that:

“the level of non-compliance continues to be a concern, as SIP16 reporting is a key factor in ensuring transparency and maintaining stakeholder confidence in pre-pack sales”

Hang on, when did SIP16 require a “report”? The Insolvency Service refers throughout to a SIP16 report. It’s funny, isn’t it, how something that started off as “disclosure”, then became a “statement”, and now is considered a “report”? I think this demonstrates how the SIP16 disclosure requirements have grown legs. And, while the report acknowledges that the RPBs state that most of the non-compliances are “minor technical breaches” and that there is “now more information available to creditors as a result of the SIP16 changes”, it seems to suggest that stakeholder confidence can only be enhanced if we eliminate even those minor breaches.

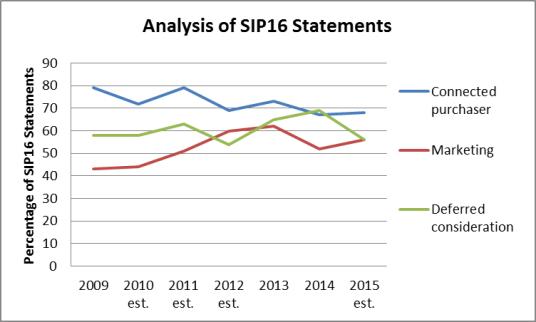

The report focuses on three areas where it seems that “greater consistency needs to be promoted across the profession”: viability statements, marketing activity and valuations.

The value of viability statements

The report indicated that, of the 2016 connected party SIP16 statements reviewed, 28% of them “stated viability reviews/cash flow forecasts had been provided”. 69% of the purchasers in these cases were still trading 12 months later. However, in the category of cases where no viability statements were evidenced, 87% of those purchasers were still trading after 12 months. This suggests to me that disclosure of a viability statement does not particularly help Newco to gain trust with creditors!

Of course, rightly so the report states that the purchasers may well have carried out their own viability work but have been unwilling to share it. What I was far less pleased about was that the report stated that “alternatively, it may be that the insolvency practitioner… is not requesting the purchaser to provide a viability statement, which would indicate non-compliance with the requirements of SIP16”. The cheek of it! If a progress report omitted the date that creditors had approved an office holder’s fees, would the Service suspect that this was because it never happened? Actually, I can believe that they would. The Insolvency Service has no evidence of non-compliance in this regard, but they can’t help but stick the boot in and foment doubts over IPs’ professionalism and competence.

Having said that, IPs would do well to double-check that they are asking for viability statements and making sure that there’s evidence of requests on the file, don’t you think..?

I wonder whether a future change will be that the RPBs will ask to be sent, not only the SIP16 statement, but also evidence of having asked the purchaser for a viability statement.

The report’s conclusion is puzzling:

“In discussions with stakeholders no concerns were raised regarding the lack of viability statements. However, the government considers that there continue to be benefits to completing viability statements for the reasons highlighted in the Graham Review. Therefore, we will work with stakeholders to encourage greater use.”

Hmm… so no one seems bothered about their absence, but the government wants to see more of them. Logical.

Compliance with the SIP16 marketing essentials

The review sought to analyse 2016 connected party SIP16 statements as regards explaining compliance with the six principles of marketing set out in the SIP. The report states:

“the principles that encourage exposure of the business to the market ‘publicised’ (54% compliance), ‘broadcast’ (53% compliance) and ‘marketed online’ (56% compliance) have only been complied with in just over 50% of cases.”

Given that they were reviewing only the SIP16 statements, I’m not sure they can say that the marketing principles have not been complied with. Might it just be that the IPs failed to explain compliance in the SIP16 statement?

Having said that, the review also revealed that, “of those that deviated from the marketing principles, over 80% of administrators provided justification for their marketing strategy”, i.e. they complied with the SIP16 “comply or explain” principle. This suggests to me that 20% of that c.50% need to try harder to get their SIP16 statements complete.

The value of marketing

The report acknowledges that “in some limited cases it may be acceptable for no marketing… to be undertaken”. I think that many would go further than this: in some limited cases, it may be advantageous not to market. The review stated that no marketing had been carried out in 21% of the 2016 connected pre-packs reviewed. This does seem high to me and I think does not help counteract suspicions of undervalue selling.

Interestingly, though, where marketing was undertaken, 46% of those connected party sales were below the valuation. But where marketing was not undertaken, 43% were below “the valuation figure”. As most IPs get valuations on both going concern/in situ and forced sale bases, I’m not sure which “figure” the Service is measuring against here. But nevertheless perhaps this is some comfort that marketing doesn’t make a whole lot of difference… unless of course it attracted an independent purchaser, which would have taken the case outside the scope of the Service’s review entirely. Shame that they didn’t analyse any unconnected SIP16s!

The compliance problem

The government’s response to the diversity in approach to marketing and to SIP16 disclosure includes that they will:

“work with the regulators to ensure: there is greater adherence to the principles of marketing”; and “there is a continued increase in compliance with the reporting requirements under SIP16”.

As I mentioned above, the report stated that SIP16 statement non-compliance was at 23% in 2019… but in her recent virtual roadshow presentation, Alison Morgan of the ICAEW stated that their IPs’ 2019/2020 rate was at c.50%. We must do better, mustn’t we?!

I too am frustrated about the levels of compliance with SIP16. I realise it’s a killer of a SIP – some of the requirements don’t follow chronologically or logically and some leave you wondering what you’re being asked to disclose. I realise that almost no pre-packs fit neatly into the from-a-to-b SIP16 ticksheet. But I don’t know when I last saw a 100% fully compliant SIP16 disclosure! I know I’m harsh, harsher it seems that some of the RPB reviewers, but whatever SIP16 asks for, please just write it down… and tell your staff not to mess with templates – they/you may think that some statements are pointless or blindingly obvious, but please just leave it in.

Expect to be “probed”!

Another part of the government’s response is to:

“ensure that where no marketing has been undertaken, the explanation provided by the administrator is probed by the regulator where necessary”.

True, SIP16 allows for a “comply or explain” approach, but if a large proportion of businesses are not being marketed, it just opens us up to the cheap shot that the sale might have been at an undervalue, doesn’t it?

What is a valid reason for not marketing? Again in her recent presentation, Alison Morgan indicated that a fear of employees walking out or of a competitor stealing the business may not in themselves be sufficient justification.

SIP16 changes in prospect

So what changes will we see in SIP16? The government response is that they:

“will work with the industry and the RPBs to prepare guidance to accompany the regulations and to ensure SIP16 is compatible with the legislation.”

Guidance? Sigh! If it’s anything like the moratorium guidance, then I don’t see why they bother: what more can they say apart from regurgitate the regulations, which are only 6 pages long?

And how is SIP16 incompatible with the regulations? Well, obviously in referring specifically to getting an opinion from the Pre-Pack Pool… but I wonder how the regulations will look when they’re finalised. With all the murmurings about almost anyone being able to call themselves an evaluator, I suspect it may be the regulations that will be brought more into line with SIP16 on this point!

But let’s hope that SIP16 is not changed to accommodate the regulations’ capture of all connected party Administration business/”substantial” asset sales within the first 8 weeks. That truly would be sledgehammer-nut territory, wouldn’t it?

The government has also threatened to:

“look to strengthen the existing regulatory requirements in SIP 16 to improve the quality of information provided to creditors”.

“Strengthen” the requirements? I wonder what they have in mind…

What about valuations?

Oh yes, I forgot: that was the third area the government highlighted for greater consistency.

Right, well, they weren’t happy that 18% of the SIP16s they reviewed failed to state whether the valuer had PII. I don’t know what they think IPs do, have a chat with a guy in a pub? So, yes, we need to check that our SIP16 ticksheets are working on that point.

The report also noted that some SIP16s didn’t have enough information to compare valuations to the purchase price, although they didn’t make a big deal of it. In her recent roadshow presentation, Alison Morgan repeated her request that IPs produce SIP16s that neatly detail the valuations per asset category alongside the price paid. (You’ll have gathered that Alison had a lot to say about SIP16 compliance – I recommend her presentation!) Although I share Alison’s view, working through the SIP’s requirements in the order listed is not conducive to presenting the valuation figures alongside the sale price, so this is definitely a SIP16 area that I think could be usefully changed.

What if SIP16 compliance does not improve?

Ooh, the government is waving its stick about here:

“Should these non-legislative measures be unsuccessful in improving regulatory compliance, the quality of the information provided to creditors and the transparency of pre-pack sales in administration, government will consider whether supplementary legislative changes are necessary.”

SIPs have pretty-much the same degree of clout as legislation. In the case of SIP16, arguably it carries a greater threat. There have been several RPB reprimands for SIP16 breaches published over recent years. How many court applications does the government think will result if they enshrine SIP16 in legislation? More than the number of RPB reprimands? If IPs are failing to comply with SIP16, it’s not because the SIP is toothless.

Will the measures solve the pre-pack “problem”?

In my view, no. There is just too much general cynicism about IPs being in cahoots with directors and about directors being determined to stiff their creditors.

What I think might help a little is if our regulators – the Insolvency Service and the RPBs – reported a balanced perspective of SIP16 compliance. I know that the report acknowledges that most SIP16 disclosure breaches are “minor technical” ones, but the simple stats grab the headline. We also need a simpler SIP16 so that compliance is easier to achieve and to measure. Concentrating on the minutiae and concluding that the statement is non-compliant just does not help. Are the minutiae really necessary? Does it improve the “quality” of the information and the transparency of the sale? I know, I know, the SIP isn’t going to get any simpler, is it?

I think the regulators might also help if they were to defend themselves and in so doing defend IPs as a whole. Do they not realise that the perceptions that pre-packs are not in creditors’ best interests is also a slight on how they may be failing to regulate IPs effectively? No one naïvely claims that all IPs are ethical and professional, so what steps have the RPBs taken to tackle the actual, suspected or alleged abusers of the process? If they have identified them and are dealing with them, then can they not publicise that fact and confirm that the rest of the IP population are doing the right thing? Instead, all we hear especially from the Insolvency Service is that, while pre-packs are a useful tool, IPs do a poor job of acting transparently and that there needs to be an independent eye scrutinising the proposed deal to give creditors confidence. Are not the regulators the policemen in this picture?